Corsa Valtaris:

Corsa Valtaris Connects Users With Crypto Education Options

Sign up now

Sign up now

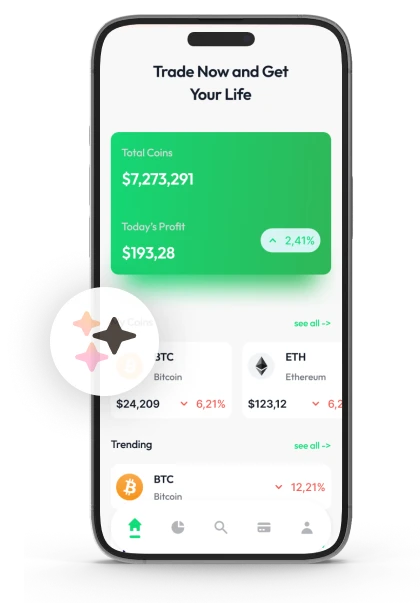

Investment education often sounds like a silver bullet. Many expect clarity to arrive overnight. Reality looks slower. Learning takes time. Context matters. Corsa Valtaris approaches education interest from a practical angle. The site focuses on linking curious individuals with independent educational firms. No lessons appear on the site. No guidance gets handed out. The aim stays simple. Create access. Let people explore education paths linked to digital assets without noise.

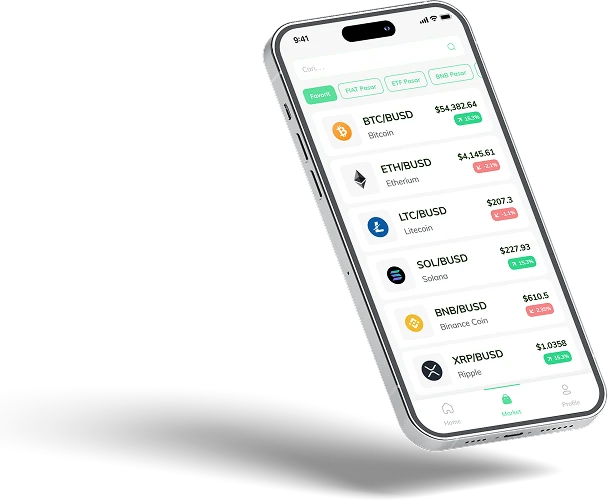

Registration makes the connection possible. Users share a full name, an email address, and a phone number. Those details allow educational firms to respond directly. Firms may explain topics covered, learning formats, or study pace. No ranking takes place. No educator receives preference. Picture walking into a bookshop and asking where the history section sits. No one tells which book to buy. The choice stays personal.

The debate around education often misses one point. Education does not remove risk. It shapes questions. It improves research habits. Comparing sources helps. Speaking with qualified financial educators before decisions helps. Asking better questions helps. What gaps feel most confusing right now? Which topics deserve deeper study? Cryptocurrency markets are highly volatile and losses may occur.

Corsa Valtaris serves people curious about investment education and unsure where to begin. Many read headlines and feel lost. Information appears scattered. Confidence drops fast. Corsa Valtaris steps in as a connector. The site links individuals with independent educational firms that discuss market topics. No lessons appear on the site. No advice gets delivered. The role stays focused on access and direction. Think of asking someone for a map instead of being driven to the destination. Relief comes from knowing where paths start.

The process begins with registration. Users share a full name, an email address, and a phone number. Those details allow educational firms to reach out and explain learning formats or subject areas. Nothing gets filtered. No firm receives priority. Some may discuss market history. Others may explain risk concepts. Curiosity drives the exchange. Research still matters. Comparing viewpoints still matters. Talking with qualified financial educators before decisions still matters. What questions feel unanswered right now? Which topics deserve deeper reading?

Corsa Valtaris does not judge quality or outcomes. Education varies by provider and by learner. Market events remain unpredictable. Sentiment shifts quickly. Learning helps frame better questions, not certainty. Personal evaluation stays essential. Many remember a first confusing chart and a quiet laugh at how little sense it made. Confusion often marks the real starting point. Cryptocurrency markets are highly volatile and losses may occur.

Corsa Valtaris manages the connection process between people and educational firms. Nothing more. Nothing less. The site receives interest signals. Those signals come from registration details. A full name. An email address. A phone number. That information allows educational firms to respond and start conversations. No lessons appear. No strategies appear. The site stays out of the discussion itself.

Education shared through connections focuses on helping people understand how markets behave over time. Topics often include how price reacts to news, how trends form, and why volatility appears without warning. Historical examples matter here. In 2018, sudden drops confused many new participants. Education often revisits such periods to explain context, not outcomes. No steps get handed out. No actions get suggested. The aim stays on understanding patterns and language used across markets.

Many educational firms discuss how narratives, data releases, and price movement interact. This type of learning helps readers spot repetition and limits. Awareness grows through frameworks rather than predictions. Some sessions focus on risk language. Others explain timeframes or common behavioural traps. It feels like learning road signs before driving at night. The signs do not move the car, yet they reduce surprises. Research habits still matter. Asking clear questions improves learning quality.

Education does not remove uncertainty. Markets react to events no one plans for. Sentiment shifts fast. Liquidity changes quickly. Learning supports interpretation, not certainty. Engagement level shapes usefulness. Evaluation remains personal. Comparing viewpoints helps. Speaking with qualified financial educators before decisions helps. What concepts feel unclear today? Which topics deserve another look before moving forward? Cryptocurrency markets are highly volatile and losses may occur.

Markets often feel loud. Prices jump. Headlines push urgency. Education helps slow reactions. Learning shows markets move in phases, not straight paths. Look back to 2000. Tech shares climbed fast, then dropped hard. Many felt shocked. Years later, similar patterns appeared again. History repeats moods, not numbers. Markets recycle old jokes with new outfits, and many laugh only after the punchline passes.

Structure brings calm. Short price swings matter less when viewed inside longer cycles. Panic shrinks when timeframes expand. In March 2020, markets fell within days. Fear moved faster than data. People who understood past crashes reacted with more patience. Calm thinking works like a seatbelt during sharp turns. Risk remains present. Framing risk changes responses.

Human behavior stays steady. Fear. Hope. Greed. Relief. Education highlights how emotions shape price patterns across decades. Charts from the 1970s, 2008, and 2022 show familiar phases. Expansion often comes before confidence peaks. Declines follow optimism. Asking why patterns return matters more than guessing dates. Questions sharpen awareness.

Learning never ends. Tools shift. Market structure adapts. Human reactions stay familiar. Regular study keeps perspective steady when conditions change. Independent research remains useful. Comparing timelines adds clarity. Speaking with qualified financial professionals before decisions adds balance. Which signals feel confusing right now? What deserves more observation before action?

Single headlines mislead. Context adds weight. Education helps arrange facts across time. Events link together. Policy changes may seem small, yet effects appear months later. Fear spreads faster than calm during sharp moves. Structure slows reactions. Patterns replace panic. It feels like lowering volume in a crowded room. Noise fades. Sense returns. Education never promises outcomes. Understanding improves by seeing how pieces connect.

Investment education helps link ideas that often feel scattered. Markets rarely move in straight paths. They pause. They speed up. They slow again. Past cycles show similar stages appearing across decades.

Accumulation often feels quiet. Volume drops. Ranges tighten. Headlines lose energy. It feels like standing in a room where music fades before a new song begins.

Many miss the silence. Education helps notice those quieter moments before attention returns.

Registration acts as the entry point for starting educational conversations. The process stays simple and focused. Users share three details only. A full name. An email address.

A phone number. Each field serves a purpose. The name identifies the request. The email supports written replies. The phone number allows follow up if needed. No learning material appears during this step. No guidance shows up. It feels like filling out a visitor card at a conference desk. Access comes first. Conversations follow later.

Once details are submitted, requests move into a structured flow. Educational firms receive the information without filtering or ranking. Responses depend on availability and focus areas. Some may explain topics covered. Others may outline learning formats or schedules. No urgency gets added. No pressure appears. The pace stays calm. During periods like 2022, when markets shifted within days, clear structure helped reduce confusion. Order matters when information arrives fast.

Consistency supports clarity. Short market moves draw attention. Longer learning paths need time. The system keeps communication steady even as conditions change. Conversations grow at a measured pace. Individuals decide how deeply to engage. Research still matters. Comparing viewpoints still matters. Asking questions improves understanding. Many remember rushing into learning once and feeling lost. Slower starts often lead to fewer regrets. Speaking with qualified financial professionals before decisions supports balance. Cryptocurrency markets are highly volatile and losses may occur.

Starting learning works best when curiosity leads, not urgency. Early steps focus on understanding basic market ideas rather than chasing outcomes. Reading about past market cycles helps build context. Events from 2000, 2008, and 2020 still shape many discussions today. Learning moves faster when questions guide the process. Many remember opening a chart for the first time and feeling lost. Confusion often marks the real starting line. Education at early stages supports awareness, not action.

Progress grows through steady observation. Comparing viewpoints sharpens perspective. Reviewing timelines adds depth. Speaking with qualified financial professionals before decisions supports balance. Research habits matter more than speed. Asking why markets behave as they do matters more than predicting dates. Learning feels less heavy when treated like a conversation instead of a test. Curiosity stays useful when pressure stays low.

During the market drop of March 2020, prices moved faster than most news updates. Indexes fell within days.

Many reacted to headlines alone. Education helped some pause and review earlier events, such as 2008, where sharp declines also followed periods of recovery.

Those familiar with past cycles understood that sudden moves often reflect fear before data settles. Education did not prevent losses or signal exact timing. It helped frame what was happening and why reactions felt intense.

Market behavior often shows hints before major shifts. Momentum slows. Ranges tighten. Volume fades. Education discussions help explain these stages without assigning meaning too early. Short pauses often appear before larger moves. Recognizing stages supports calmer observation over time.

Corsa Valtaris supports this learning process by connecting individuals interested in investment education with independent educators. Through these connections, people explore how market phases are commonly studied and discussed. Registration allows this contact to begin.

A full name, email address, and phone number enable communication. No material appears during sign up. The system exists only to open dialogue, leaving interpretation and decisions with the individual.

Corsa Valtaris does not change how markets behave. Markets move on policy shifts, capital flow, sentiment, and unexpected events. The site focuses on something simpler. Access. It helps people reach independent educational firms without adding opinion or direction. That separation matters. Learning conversations start without pressure to act or decide quickly.

The connection role becomes useful when interest rises fast. During sharp moves, many search for explanations before understanding questions. Corsa Valtaris supports slower entry into education by keeping the process structured. Registration opens contact. Nothing else. No material appears. No views are shared. It works like a reception desk during a busy conference. Introductions happen. Conversations happen elsewhere.

Sharing contact details requires care. Corsa Valtaris handles only what is needed to start communication. Names, email addresses, and phone numbers move through a controlled process.

The goal stays narrow. Allow educators and individuals to connect without unnecessary exposure. No public display exists. No extra use appears. It feels like locking the door before leaving home. Nothing dramatic happens, yet calm stays intact.

Information shared during registration serves one purpose. Opening a line of contact. Details are not sold. Nothing gets displayed openly. Educators receive the information to respond directly. Conversations stay focused on learning topics rather than data handling. Clear limits help keep expectations steady. Caution still matters. Reviewing what gets shared remains a wise habit.

Learning material does not sit on the site. Educators explain ideas directly during communication. Topics often include market history, risk awareness, and how behavior shaped events in years like 2008, 2017, or 2022. These discussions explain context rather than outcomes. Timelines matter. Markets do not follow calendars. Education helps frame what already happened, not forecast what comes next.

Educational views differ. Some focus on long cycles. Others highlight short term behavior. Comparing viewpoints helps place ideas in perspective. Independent research remains useful. Asking clear questions sharpens understanding. Speaking with qualified financial professionals before decisions supports balance. Many recall borrowing a book and returning it with notes in the margin. Learning grows through exchange, not ownership.

Safe interaction depends on both sides. Sharing only required details keeps communication clean. Reading messages carefully reduces confusion. Asking questions prevents assumptions. Education conversations work best when expectations stay simple. Understanding grows faster when roles stay clear.

Investment education often helps shift attention away from single price moves toward longer timelines. Markets change pace often. Some days feel fast. Others slow down. Learning encourages stepping back and observing how trends form, pause, and restart. This broader view helps reduce overreaction when short term noise appears. Education focuses on patterns across time, not instant conclusions.

Corsa Valtaris supports this perspective by connecting individuals with independent educators who discuss markets through historical examples and structured observation. Access stays steady even when conditions feel unstable. It resembles watching traffic from a hill instead of standing at a crowded crossing. Movement feels easier to read from a distance. Education does not predict direction. It supports clearer thinking, better questions, and calmer review of what unfolds over time.

Registration allows contact details to move into an organized flow. A full name, email address, and phone number help route interest correctly. Educational firms may reach out to explain learning formats or subject areas. No lessons appear during registration. No instructions appear. It resembles requesting an introduction rather than joining a class. The next step depends on conversation, not automation.

Uncertainty remains part of all markets. Education helps frame information rather than resolve outcomes. Learning often explains how data, timing, and structure interact over longer periods. This awareness supports slower interpretation when prices move quickly. History shows uncertainty never disappears, only changes form. Education supports clarity around limits, not certainty.

Corsa Valtaris stays centered on coordination. The role stops at opening communication paths. Teaching, interpretation, and evaluation occur elsewhere. This separation keeps expectations clear. Research remains personal. Comparing ideas matters. Speaking with qualified financial professionals before decisions supports balance. Cryptocurrency markets are highly volatile and losses may occur.

| 🤖 Initial Cost | Registration is without cost |

| 💰 Fee Policy | Zero fees applied |

| 📋 How to Register | Quick, no-hassle signup |

| 📊 Educational Scope | Offerings include Cryptocurrency, Forex, and Funds management |

| 🌎 Countries Serviced | Operates globally except in the USA |